(Bloomberg) — Stocks fell on Friday, closing out the worst week in more than two months, as Trump trades lost steam and investors bet the Federal Reserve will have to slow the pace of policy easing.

Most Read from Bloomberg

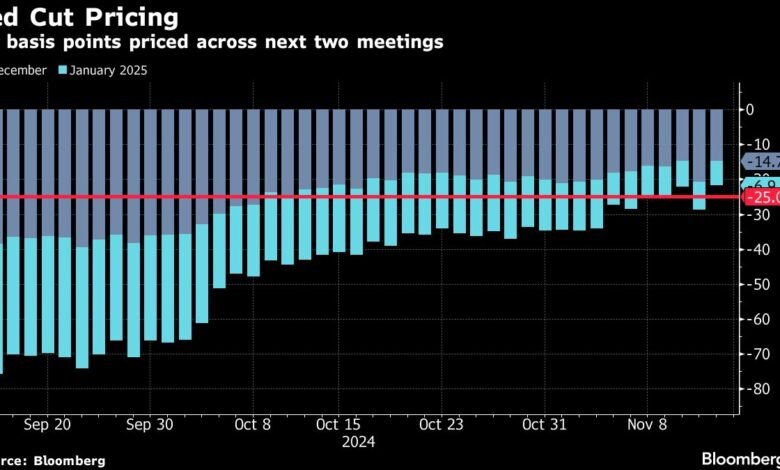

The S&P 500 ended off session lows, with tech stocks leading declines. The benchmark has now erased over half of the trough-to-peak gains it notched after the US presidential election. Traders see slightly more than even odds of a quarter-point cut next month following comments by Jerome Powell this week indicating the Fed was in no hurry to lower rates and a report Friday on October retail sales that included large upside revisions to the prior month.

As the initial euphoria about President-elect Donald Trump’s pro-business agenda begins to fade, investors are coming to terms with the costs of his fiscal plans and their potential to reignite inflation.

“It will come at the expense of potentially larger budget deficits, potentially larger debt and there is also the inflation dimension,” said Charles-Henry Monchau, chief investment officer at Banque Syz & Co. “There’s been a realization that there is a price to pay for this.”

For the week, the S&P 500 was down 2.1% and the tech-heavy Nasdaq 100 dropped more than 3%, both posting the biggest declines for the period since Sept. 6. On Friday, shares of all “Magnificent Seven” megacaps retreated except Elon Musk’s Tesla Inc., with Amazon.com Inc., Nvidia Corp. and Meta Platforms Inc. sliding more than 3%. Applied Materials Inc., the largest US maker of chip-manufacturing equipment, suffered its worst stock decline in a month after giving a disappointing revenue forecast.

Late Friday, traders priced about a 56% chance the Fed will deliver a quarter-point reduction at its December meeting, down from 80% earlier this week. Bets on cuts were pared after Powell warned Thursday that the central bank may take its time easing policy.

Boston Fed President Susan Collins said Friday a December cut remained on the table, emphasizing the central bank’s decision will be guided by incoming data. Chicago Fed chief Austan Goolsbee said as long as inflation continues down toward the central bank’s 2% goal, rates will be “a lot” lower over the next 12-18 months. He agreed with Powell, however, noting policymakers aren’t in a hurry to lower borrowing costs.

Source link